Funding Scholarships Through IRA Contributions

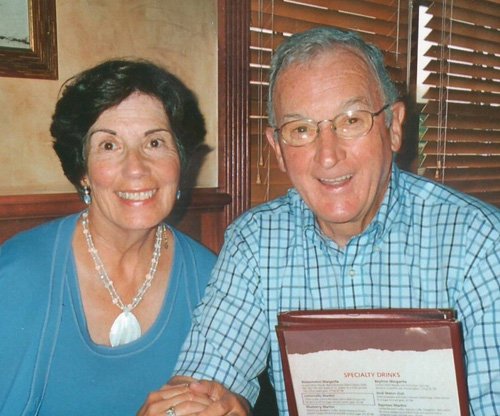

The Downey's

In 1975, the first of our three sons entered Notre Dame. We came to know the Brothers of Holy Cross, the friendly faculty and staff, and the mission the school stands for, then and now. Not only did Notre Dame gather our sons into their close-knit community, but they embraced our family as well. The tradition continues with our grandsons, who follow in our sons’ footsteps.

We both have had the honor of serving on the Notre Dame Board of Directors. While serving, we noticed an amazing camaraderie among the alumni members, a shared spirit we had not witnessed in any other setting. They were there solely to give back to the high school they revered many years before.

Over the years, we have gladly supported projects including the addition of the new wing and enhancements to the outdoor fields, but our hearts are drawn to providing scholarship assistance to those who could not afford the tuition. Gifts can go to a designated purpose or become part of the Loyalty & Endowment Fund, which grows over time through careful investing.

For the last eight years, one of the ways we’ve made gifts is through a provision in the tax code that allows IRA holders to give directly to a designated charity their required minimum withdrawal, a process that begins at age 70.5.

We have found it an effective way to give. The money does not count as taxable income because rather than pass through our hands, it goes directly from the bank to the charity. Notre Dame gets the benefit of the full amount withdrawn, with no taxes subtracted. Not only does it minimize our taxes, but it also provides Notre Dame with larger gifts.